Compliance, Confidence, Maximum Recovery.

Accurate, On-Time Aviation Fuel Tax

Filings

Accurate, On-Time Aviation Fuel Tax

Filings

Powered by your validated dataLogicraft processes aviation fuel tax returns for airlines using audited flight and fuel data.

We reconcile multi-source tickets, inventory movements, and purchases, then generate filing-ready reports to help you stay compliant,

reduce effort, and capture credits or overpayment recoveries.

Fuel Tax Solutions

Data-Driven Accuracy

Cross-checks across fueling tickets, inventories, invoices, and routing data.

Compliance Confidence

Filing logic aligned with jurisdictional fuel tax rules and exemptions.

Lower Back-Office Load

Automated custom reports and schedules your finance team can approve.

Why Airlines Choose Logicraft?

Unified Fuel Data Pipeline

Data sourced from IPA/M&O systems, supplier feeds and file uploads -> normalized -> validated

Ticket-to-Tax Traceability PRO

Every gallon in tax filings can be traced back to uplift tickets, inventories and invoices

Exception Management

Duplicates, 0-gallon tickets, defuels, reversals and adjustments per your policy

Jurisdiction Mapping

Applies local rules, tax rates, exemptions and international flight treatments

Audit Ready Output

Clear schedules, summaries, and supporting evidence for internal and external review.

Book a Discovery Call

From raw tickets to filed returns...backed by continuous data QA.

The process

Monthly/quarterly aviation fuel tax returns and schedules

State and local tax computations with exemption logic

Reconciliation reports: tickets ↔ inventory ↔ invoices

Variance and exception logs with resolution notes

Submission packs for finance sign-off and e-filing

1

Data Intake

COLLECT & NORMALIZE

- Automated pulls from IPA portals and accounting servers

- Secure ingestion of emails, PDFs, Excel, and CSVs

- Standardization into a common schema

2

QA & Reconciliation

VALIDATE & RECONCILE

- Ticket validation, duplicate detection, defuel handling

- Inventory movements, gains/losses, and adjustments

- Invoice cross-checks and tolerance-based flags

3

Computation

CLASSIFY & COMPUTE

- Domestic vs. international flight treatment

- Jurisdictional rates and exemptions applied

- Credit and overpayment

4

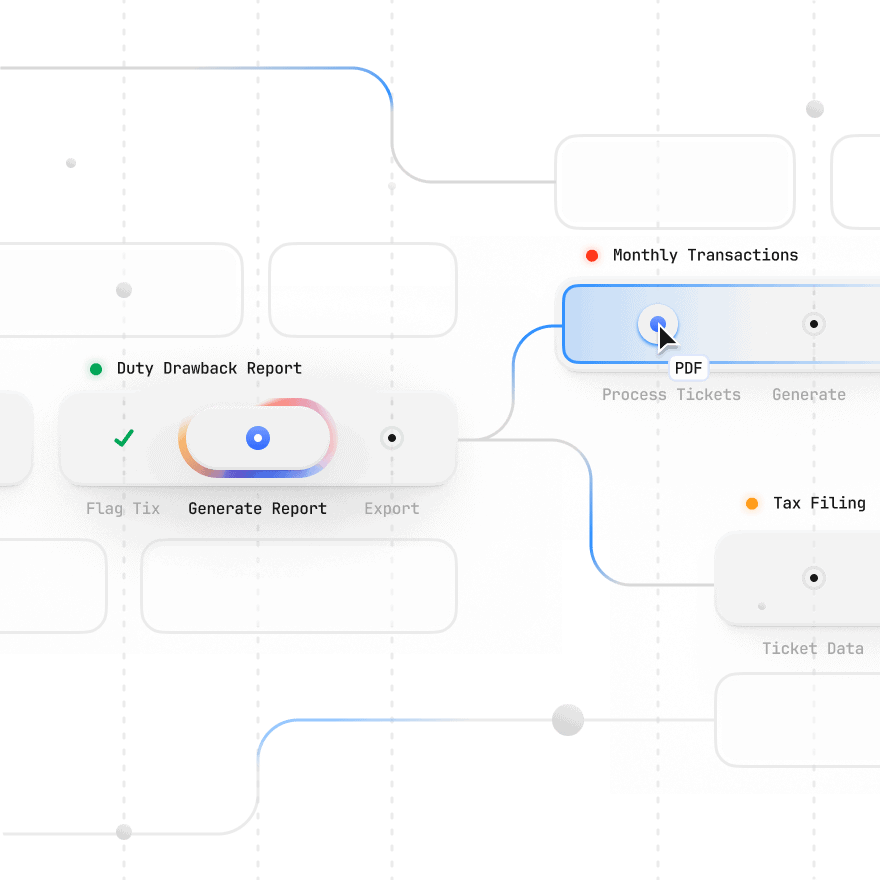

Reporting

ASSEMBLE RETURNS

- Filing schedules and summaries by period

- Support docs and audit trail linkage

- Variance notes and exception resolution

5

Filing

SUBMIT & TRACK

- E-file or submit per jurisdiction requirements

- Payment coordination (ACH, wire, check)

- Receipt tracking and confirmation archive

6

Ongoing Tax Advocate

CLOSE & IMPROVE

- Month-end close feeds to finance systems

- Trend reports and exception heatmaps

- Continuous logic tuning and rule updates

What we provide

Returns

Monthly/quarterly aviation fuel tax returns and schedules

Local

State and local tax computations with exemption logic

Reports

Reconciliation reports: tickets ↔ inventory ↔ invoices

Logs

Variance and exception logs with transaction resolution notes

Filing

Submission packs for finance sign-off and electronic filing

Duty Drawback

CBP-compliant Jet-A drawback reports for customs brokers

Benefits at a Glance

Savings

Capture credits and avoid penalties or interest from late/incorrect filings.

Compliance and Controls

Built In Controls

-

-

-

-

Auditor-Preferred Output

-

-

-

-

`